When investing, you can consider the stock market or funds you buy in your workplace. Gold is not a typical investment; most experts still think it is the best portfolio. Gold was used as an investment and currency before the stock market. Except for its use in decorations and jewelry, it is used as a currency.

The value of gold has previously been driven by demand, production, and the fiat currency. Gold can be the best option for someone looking for a low-risk investment, but it also comes with challenges. When considering investing in gold, you can ask J.Rotbart & Co. Singapore to set you some options. There are many things to consider before adding gold to your investment portfolio. When you like to ask yourself the same questions, you must do it before you buy other investments.

Reselling

With any investment, it is necessary to consider its liquidity, which means how fast you can turn the asset into cash. You have to be aware that gold is less liquid than any investments you have. With stock investing, you can sell an asset through an online brokerage account, but with gold, you must look for a buyer. You have many options for reselling your gold, like online retailers and dealers where you bought it. When you buy the gold, you must ask the dealer whether they can repurchase assets.

Insurance

Gold is different from other investments because it is a physical asset that can be stolen or damaged. It will result in getting insurance to protect all your assets. Before investing in gold, you must know the insurance costs of your overall budget.

Storage

When you think about buying gold, you must plan how to keep it. Some investors keep their gold in their homes with a locked safe, but others use a safety deposit box. Some companies focus on keeping gold and other metals. You will have to pay to keep your assets there, but it can be a sign of relief to keep them to yourself. Maintaining gold with a depository will be expensive; you must spend your money on storage and fees with a private depositary. Fees charged will depend on the amount of gold or metal stored.

Quantity

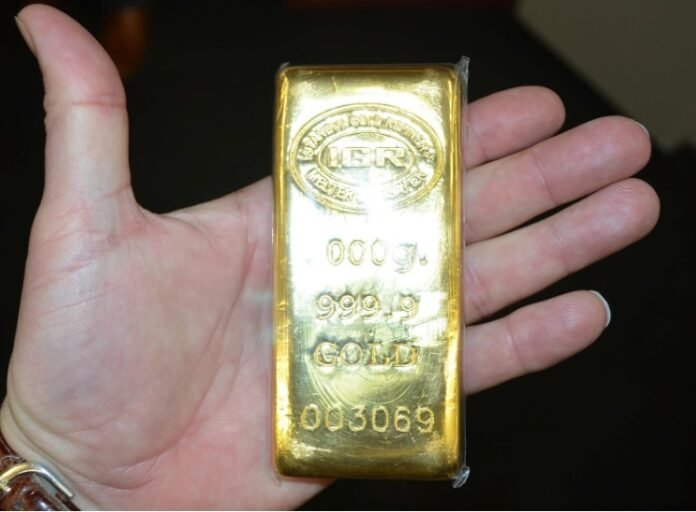

There are many reasons to think about the quantity of gold you like to buy. Gold is a physical asset where you have to plan for storage, shipping, and insurance, where it can improve your investment costs. However, you need to consider the quantity from the lens of your overall investment portfolio. You know that gold is part of a well-diversified investment portfolio. When buying less, you can end up with an asset allocation where it could be better. It would be best if you planned on what percentage of your investment portfolio must be devoted to gold. However, you must ensure it will balance with other assets that help you to reach your financial goals.

There are many cases where the emotion is fear of stock market fluctuations. It is because gold is a commodity you can hold that will not make it a wise investment. When the stock market movements make you nervous, you must try a long-term view and know that market volatility is average. The best you can do for your portfolio is to follow your investment plan and not rush out to buy gold bars.